Housing security is multivariable – it is connected to affordability, availability of social housing and government support, economic stability and myriad other indicators. We set out to understand how cities in England and Wales compare with one another in terms of housing security – specifically in light of Covid-19 – by analysing several of these indicators. While such an index can hope to be representative, it can never be exhaustive.

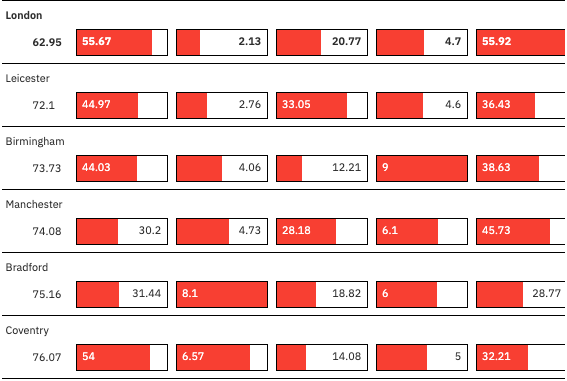

We have created an index comprising 12 indicators across 29 large urban areas that we refer to as “cities”. It should be noted that not all of these areas have official city status, but in the UK this is something of a constitutional quirk that has no direct bearing on a locality’s size or importance. We have used local-authority boundaries for all “cities” except London, as official data is generally collected at that level. For London, we have used regional data.

You can interact with the index above and read the story about our findings.

Through interviews with experts, we were able to identify indicators that were most strongly related to housing security. Each indicator we used was weighted based on its perceived importance.

Here are the indicators we used, in order of how heavily they were weighted in the final calculation:

- Eviction claims rate

- Homelessness threat rate

- Unemployment rate

- Homeownership affordability

- Rent affordability

- Foreclosure claims rate

- Percent social housing

- Percent change in social housing

- Percent employment in service occupations

- Dependency ratio: non-working to working-age population

- Labour force participation rate

- GDP per capita

The raw data for each city was compared with those of all others and rescaled to a score between 1 (worst) and 10 (best). The weight of each indicator was then applied to each score to produce the weighted score. The sum of the weighted scores gave the overall index score. These scores were then rebased so the top-scoring location scored 100 (overall weighted score).

Below is more information about each indicator that made it into our index.

Eviction claims rate, 2018

The eviction claims rate represents the number of repossession claims issued by landlords per 10,000 rental households. Not all eviction claims result in the removal of the tenant from the household.

Eviction claims rates are an important measure in housing security because research shows that evictions, especially no-fault evictions, can lead to homelessness.

Repossession data is from the Ministry of Justice, 2018; household data is from the Ministry of Housing, Communities & Local Government, 2018.

Homelessness threat rate, Jan–Mar 2020

The homelessness threat rate is the number of households per 10,000 that were threatened with homelessness within two months of the recorded date. Areas with a higher homelessness threat experience more strain on local-government resources, as finding dwellings for the homeless is a statutory requirement for local authorities.

Homelessness data comes from the Ministry of Housing, Communities & Local Government and the Welsh government. Homelessness threat numbers for Wales are for the date range 2018–19.

Unemployment rate, Apr 2019–Mar 2020

Cities with higher rates of unemployment will have more people who struggle to keep up with rent and mortgage payments.

Unemployment statistics come from Nomis.

Homeownership affordability, 2019

Homeownership affordability is the ratio of median house price to median gross annual residence-based earnings. Residents in cities with higher affordability ratios have a harder time affording mortgages, especially during times of economic instability.

This data comes from the ONS.

Rent affordability, 2019

Rent affordability is the percentage of monthly income that a resident making the median income would need to pay to afford the median rent for a two-bedroom apartment. People who already have a high percentage of monthly income going to rent payments are likely to have less money to direct towards savings and emergency funds. They are therefore more vulnerable in the face of job loss and other economic insecurities brought about by Covid.

Rent data comes from the Valuation Office Agency, and income data comes from the ONS.

Foreclosure claims rate, 2018

The foreclosure claims rate represents the number of repossession claims issued by mortgage companies per 10,000 privately owned households. Not all foreclosure claims result in the removal of the homeowner from the household.

Repossession data comes from the Ministry of Justice, 2018; household data is from the Ministry of Housing, Communities & Local Government, 2018.

Percent social housing and percent change in social housing, 2012–19

Social-housing counts include units owned and let by local authorities as well as those managed by associations.

The availability of social housing is an important factor in security. Cities with less social housing may see more residents on rental assistance and could be more prone to a surge in homelessness in the event of economy-wide job loss.

Figures come from the Ministry of Housing, Communities & Local Government and from the Welsh government.

Percent employment in service occupations, Apr 2019–Mar 2020

Some jobs are more susceptible to Covid layoffs: among them are leisure- and service-related jobs. Cities where higher percentages of the population depend on this type of employment will have more people with lost wages and missed rent and mortgage payments.

This data comes from Nomis.

Dependency ratio: Non-working to working-age population, 2019

The dependency ratio we used in this index was the ratio of non-working to working-age population. Cities with high dependency ratios have a less stable balance of workers to non-workers, meaning that a single person may support many non-working family members. Covid layoffs could affect these populations more by putting the sole breadwinner out of work.

This data comes from Nomis.

Labour force participation rate, 2019

Labour force participation rate is the percentage of the working-age population that is either working or looking for work. Cities with low labour force participation rates have fewer labour resources to draw on to produce goods and services to recover distressed economies.

This data comes from Nomis.

GDP per capita, 2018

GDP per capita is a measure that reflects all the goods and services produced by a city, per resident, in a given year. Cities with low GDP per capita are weaker economically and may experience sharper economic impacts from Covid job loss and business failures.

These data come from the ONS.